Test webpage

Rates are used to provide essential services and infrastructure the whole community can enjoy including roads, footpaths, sporting fields, cycleways, parks, playgrounds, libraries, waste management and other public amenities.

Paying Your Rates

Your rates can be paid in full or by instalments. Instalment due dates are as follows each financial year:

- 1st Instalment: 31 August

- 2nd Instalment: 30 November

- 3rd Instalment: 28 February

- 4th Instalment: 31 May

Payment options include:

Online:

You can pay your rates and charges electronically using:

When logged in, please quote biller code 1917 and ensure the 6 digit customer reference number entered (not assessment number) is the same as that listed on your rates notice under the BPOINT logo. Please ensure the 6 digit reference number is correct for your property.

Credit card transactions incur a merchant service fee of 1% by Mastercard, Visa and American Express.

BPAY®/BPAY View®:

BPAY® gives you the opportunity to pay your rates and charges over the phone or via the internet, from either your savings, cheque, debit, credit card (no service fee will apply) or transaction account.

BPAY View® allows you to pay your notices via your online banking portal. To use BPAY® and BPAY View®, you will need to be registered for internet banking with your financial institution.

When logged in, please quote biller code 1917 and use the 6 digit customer reference number (not assessment number) as shown on your rates notice under the BPAY® logo.

Direct Debit:

You can set up a direct debit through Council and elect to pay your rates and charges either annually or by quarterly instalments.

Annual deductions will be debited on 31 August.

Quarterly deductions will be debited on 31 August, 30 November, 28 February and 31 May.

Payments can only be deducted from a cheque or savings account. We cannot process a direct debit from a credit card. To apply, please complete the Direct Debit Form and return by either:

- Post: PO Box 211, Spit Junction NSW 2088

- Email: rates@mosman.nsw.gov.au

- In person with our Customer Service team at the Civic Centre

If you have an existing direct debit arrangement and wish to update your bank account details you must complete a new Direct Debit Form. Please tick the amend existing detail box and update the form with your new details.

Alternatively, to cancel a direct debit you will need to advise Council in writing. Simply email rates@mosman.nsw.gov.au making sure to include your assessment number and property address. Once this is actioned one of our rates team members will advise you of the cancellation.

For more information regarding direct debit, please visit the "Set Up or Change a Direct Debit" tab below.

By Phone:

Pay 24 hours a day, 7 days per week by telephoning 1300 276 468 using your credit card (American Express, Mastercard or Visa). You will need to quote the biller code 1917 and the 6 digit customer reference number as shown on your rates notice under the Credit Card logo.

Credit card transactions incur a merchant service fee of 1% by Mastercard, Visa and American Express.

In Person:

Payments can be made in person by visiting the Mosman Civic Centre located at 573 Military Rd, Mosman, between 8.30am and 5pm Monday to Friday.

Council accepts EFTPOS, credit cards (American Express, Mastercard or Visa), cheques or money orders. We do not accept cash.

Credit card transactions incur a merchant service fee of 1% by Mastercard, Visa and American Express.

Australia Post:

You can pay your rates and charges at any branch or agency of Australia Post using either cash, cheque, credit cards (American Express, Mastercard or Visa) or EFTPOS. Please present the intact rates notice at any post office. A paper receipt will be issued.

Credit card transactions incur a merchant service fee of 1% by Mastercard, Visa and American Express.

By Mail:

You can post your payments to us using a cheque or money order made payable to Mosman Municipal Council, together with the detachable payment options slip of the rates notice to:

PO Box 211, Spit Junction NSW 2088

Please allow sufficient mailing time to ensure payment is received no later than the due date to avoid interest being charged.

Missing or incorrect payments:

If you believe a payment was made and is not showing on your rate account, or is showing incorrectly, please contact the Rates team to investigate the problem. Having the following information will assist us with locating your missing payment:

- The reference number used to make the payment

- The amount paid

- The date payment was made

- A bank/credit card statement showing the payment made to Council

Set Up or Change a Direct Debit

You can set up a direct debit through Council and elect to pay your rates and charges either annually or by quarterly instalments.

Annual deductions will be debited on 31 August.

Quarterly deductions will be debited on 31 August, 30 November, 28 February and 31 May.

To set up direct debit payments, you need to:

- be the property owner or authorised representative

- know your assessment number of your rate account

- have an account with a financial institution that offers direct debit transactions (check with your financial institution)

- have sufficient funds available on the date your bill is due.

Payments can only be deducted from a cheque or savings account. We cannot process a direct debit from a credit card.

Please note, any amounts owing on your rate account on the date the payment is due will be deducted. This will include overdue instalments and accrued interest if there is any. If there is nothing owing on your rate account for that period, the direct debit will not deduct any payments.

To apply, please complete the Direct Debit Form and return by either:

- Post: PO Box 211, Spit Junction NSW 2088

- Email: rates@mosman.nsw.gov.au

- In person with our Customer Service team at the Civic Centre

If you have an existing direct debit arrangement and wish to update your bank account details you must complete a new Direct Debit Form. Please tick the amend existing detail box and update the form with your new details.

Alternatively, to cancel a direct debit you will need to advise Council in writing. Simply email rates@mosman.nsw.gov.au making sure to include your assessment number and property address.

A confirmation email will be sent to the nominated email address to confirm the status of your application.

Please note, if you own multiple properties, you will need to register each property separately.

Register for eNotices

In an effort to reduce waste, Council has the facility for ratepayers to register online to receive their rates notices electronically through our Ezybill portal. It’s a free service for ratepayers, is easy to navigate and is better for the environment. Once you register, you will receive future rate notices electronically delivered to your email, and have 24/7 access to download/print additional copies of notices (from the date of activation) if needed.

To register for Ezybill you will need to:

- Register your details on the Ezybill website. This will include your full name or company name, email address, a password and mobile number.

- When registered, a verification email will be issued to your nominated email address.

- Open the email and click the link to verify your registration and activate your account. This link expires 4 hours from the time of issue. However, there is an option for you to request an updated activation account if you were unable to do it within that timeframe.

Once your account is activated, you will need to enter:

- Your assessment number

- Full name, or company name (typed exactly as it appears on your rates notice)

Click on the button below to register.

You are responsible for ensuring you receive your emailed rates and charges. We take no responsibility for non-payment of rates and charges that have been emailed to you.

If you registered for Ezybill and have not received your confirmation email or your emailed rates notice, we recommend:

- checking your spam or junk folder - if you find an email from Ezybill (noreply@ezybill.com.au) in your spam or junk folder, you will need to tell your email software that the message is not spam (use the not spam or not junk button)

- adding Ezybill’s email address (noreply@ezybill.com.au) to your email's safe senders list (also known as contacts list or white list) to ensure you receive the emails

- If you need more information about how to add email addresses to your safe sender list, visit the help page of your email service provider.

For help from us, you can contact us by email rates@mosman.nsw.gov.au or phone 02 9978 4140.

Please note – Signing up for Ezybill is for the delivery of rate notices only. All other Council related correspondence will continue to be issued to your postal address on file, so please keep your postal details up to date with us. To update your address details, please fill out the Address Change Notification Form.

BPay View® is another service Council provides which sends an electronic rates and charges notice to the online bank that you use to pay them, and depending on your bank, can remind you by sending a convenient SMS, email or bank message.

To register for BPay View®, simply log on to your online banking account, look for the ‘BPay® 'View Bills' heading, and register to receive the Mosman Council rates notices.

You will need to enter:

- BPAY® Biller Code: 1917

- Your 6 digit BPAY® View registration number. (which is located under the BPAY® logo in the payment section on your rates notice)

- Your name (typed exactly as it appears on your rates notice)

If you are not registered for internet banking or need help to register for BPay View®, please contact your bank.

Pension Concession Rebate

Under the Local Government Act 1993, Section 575, eligible pensioners can receive an annual rebate of up to $250 per annum per household on their rates and charges.

To be eligible for the pension rebate, pensioners must meet the following criteria:

- The pensioner must be listed on the Certificate of Title as the owner of the property

- The pensioner must reside at the property as their sole principle place of residence

- The name and address of your property must be identical to what’s on your pension card.

Cards eligible for the pension rebate:

- Holders of the Pensioner Concession Card (PPC)

- Holders of a gold card embossed with 'TPI' (Totally Permanently Incapacitated)

- Holders of a gold card embossed with 'EDA' (Extreme Disablement Adjustment)

- War widow or widower or wholly dependent partner entitled to the Pensioner Concession Card*

* If you are a war widow or widower or wholly dependent partner but do not have a Pensioner Concession Card, you should contact the Department of Veterans' Affairs (DVA) to test your eligibility for the DVA income support supplement. Eligibility is subject to an income and assets test. Holders of cards other than those listed above are not eligible for the concession.

Cards not eligible for the pension rebate:

- Health Care Card

- NSW Government Seniors Card

- Commonwealth Seniors Health Card

For assistance regarding eligibility, please contact Centrelink 132 300, Department of Veterans’ Affairs 133 254, or Council 02 9978 4140.

Claiming the rebate:

If you meet the criteria above, please complete the Pension Concession Application form. As part of your application, you will need to provide a copy (front and back) of your Pension Concession Card as an attachment in the form. Please scan or take a photo of the cards to upload.

Please note: A separate form will need to be completed for each eligible pensioner to receive the maximum rebate, otherwise a partial rebate will be granted.

Once completed, submit the form to Mosman Council via email to rates@mosman.nsw.gov.au, post to PO Box 211, Spit Junction NSW 2088, or visit Council at our Civic Centre.

The form can also be completed in person at the Civic Centre. Please bring along your Pension Concession Card.

All applications will be verified through Centrelink/Department of Veterans’ Affairs before the rebate can be applied to your rates. Once validated, the rebate amount granted will be proportionate to the percentage of ownership and will apply from the beginning of the next rating quarter from the date of eligibility.

For assistance completing this form, please contact Council on 02 9978 4140.

Update Your Postal Address

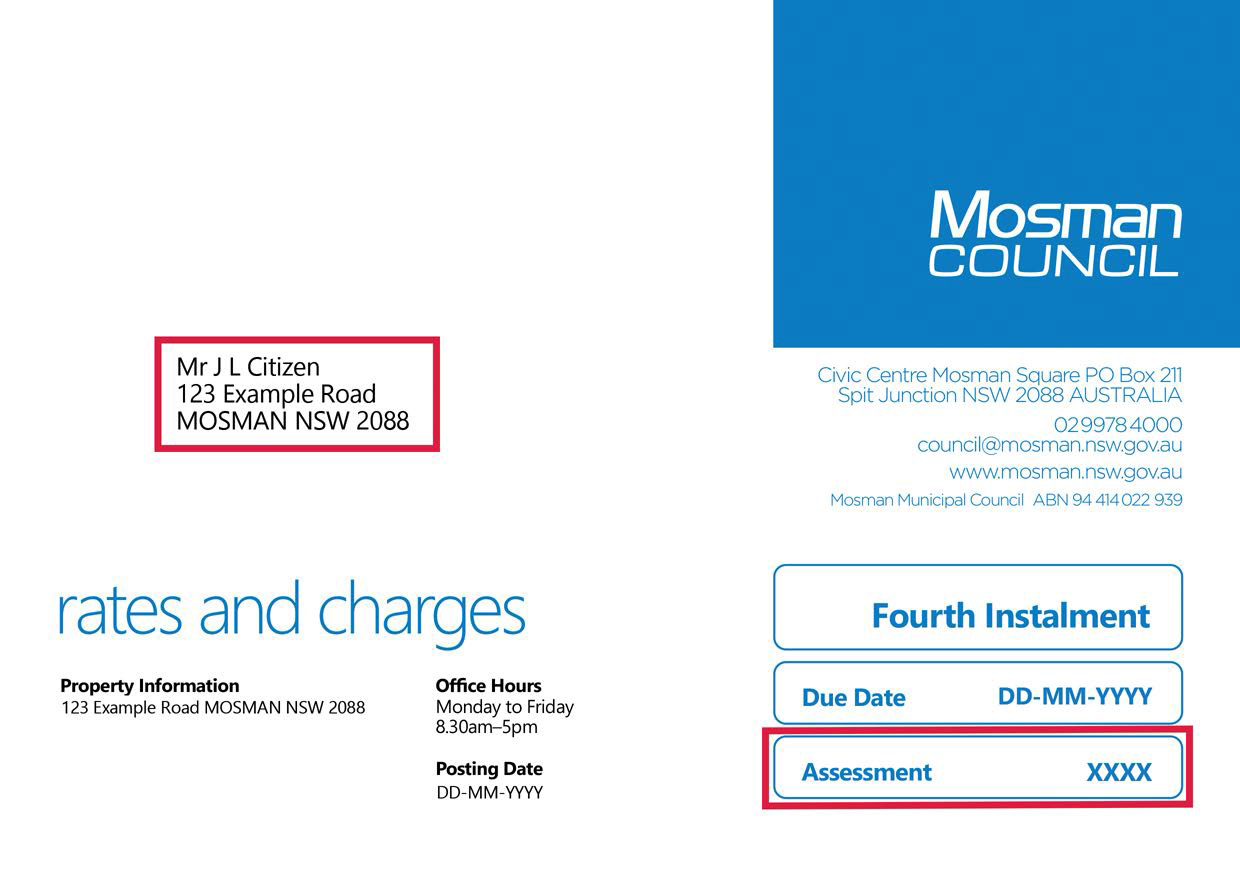

To ensure your property details are accurate and up to date, you must notify Council if your current postal address is different from the address shown on the front of the Rates Notice.

To update your postal address, please fill out the Address Change Form.

If your property is managed by an agent, they may advise us on your behalf by completing the Address Change Form.

Note: We cannot accept change of address notifications over the phone.

Confirmation that your address has been updated with be sent to you or your managing agent.

If your rate notices are being emailed, Council still requires an up-to-date postal address as all other Council related correspondence will continue to be issued to your postal address.

If you wish to change the email address for receiving electronic notices, please log on to your Ezybill account and update your details.

Section 603 Certificates

A Section 603 Certificate (Local Government Act 1993) advises the amount (if any) due or payable to Council – by way of rates, charges or otherwise – on a parcel of land.

To apply and pay for a 603 certificate, please complete the Section 603 Application form.

If an admin notice is returned with the 603 certificate stating the property is a company title property, a transfer of shares form will need to be completed and returned to Council. Please refer to the Transfer of Shares in a Company Title Property tab below.

Transfer of Shares in a Company Title Property

Many properties within Mosman are company titles properties. To ensure the correct owners are reflected upon transfer, the solicitor must advise Council of the new title of ownership.

To do this, please complete the Transfer of Shares form.

Land Valuation

For rating purposes, land in NSW is valued by the Valuer General under the Valuation of Land Act 1916 and a new valuation is provided every 3 years. The valuation is based on the unimproved capital value of the land (the value of the block of land if no structural improvements had been made). Councils use of land values to distribute rates across our local government area and is done by using a combination of the land value of the property, and a fixed amount per property.

A change in land value does not necessarily lead to a similar change in rates.

Any objections or appeals regarding the valuation of the land value must be directed to the Valuer General's Office on 1800 110 038 or by visiting the Valuer General’s website. Whether or not an objection is pending, the rates levied must be paid by the due date indicated on the front of your rate notice.

To find out more about how land values affect your rates visit the Valuer General's website.